- President Donald Trump has been on a nearly six-month long tariff spree, kicking off trade wars with several countries.

- Trump has placed tariffs on everything from steel to chicken incubators.

- Trading partners including China, Canada, the European Union, and Mexico have hit the US with retaliatory tariffs.

- Here’s a breakdown of how we got here and what the tariffs mean for the economy.

President Donald Trump declared on March 2 via Twitter: “When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win.”

The tweet marked the announcement that the US would impose tariffs on steel and aluminum imports coming into the country – and the start of a growing trade war.

Since that point, Trump has opened up trade battles on a series of fronts, and the US and other countries around the world have slapped tariffs on $85 billion worth of goods.

Trump has long been a fan of tough action on trade. In the 1980s, the then-real estate mogul railed against the US’s trade deficit and warned of “other countries ripping off the United States.” In a 1990 Playboy interview, Trump was asked about his first action if he ever became president.

"Many things. A toughness of attitude would prevail," Trump said. "I'd throw a tax on every Mercedes-Benz rolling into this country and on all Japanese products, and we'd have wonderful allies again."

Given the president's decades-long history of protectionist statements and direct signals on the campaign trail, the recent spate of trade restrictions should come as no surprise.

So far, Trump has used tariffs as the main weapon in his trade war. A tariff is a tax on a good coming into the US, also known as a duty. These duties are collected by Customs and Border Protection at the good's port of entry. Once tariffs go into place, importers face the extra fee immediately.

Trump placed tariffs on a wide variety of goods and the moves are starting to make an impact on the US economy, prices, and more. Here's a breakdown of how Trump's trade fight is starting to take its toll.

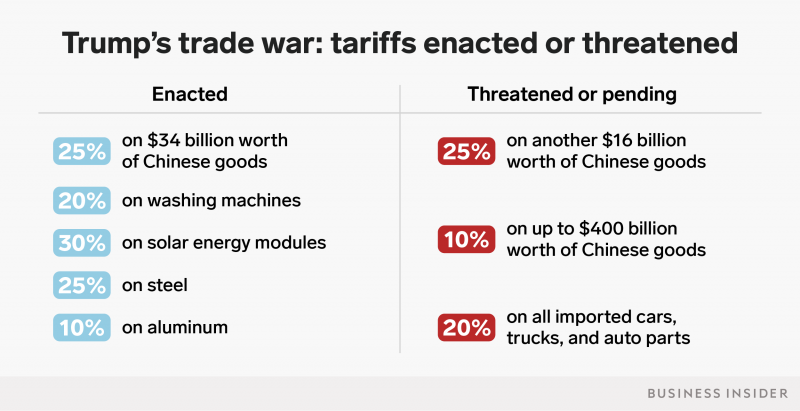

The number of tariffs Trump has enacted or threatened is piling up.

Trump's hard line on trade kicked off in February, when the administration officially placed tariffs on imports of washing machines and solar energy equipment.

But the protectionist push began in earnest at the start of March, when Trump announced a 25% tariff on imported steel and 10% tariff on imported aluminum. This move triggered widespread pushback from allies, since the tariffs were implemented on national security grounds.

Allies like Canada, the European Union, and Mexico argue that they pose no national security risk to the US and thus should not be slapped with tariffs. Those three countries, along with China and others, have filed a suit against the US with the World Trade Organization arguing the tariffs are illegal.

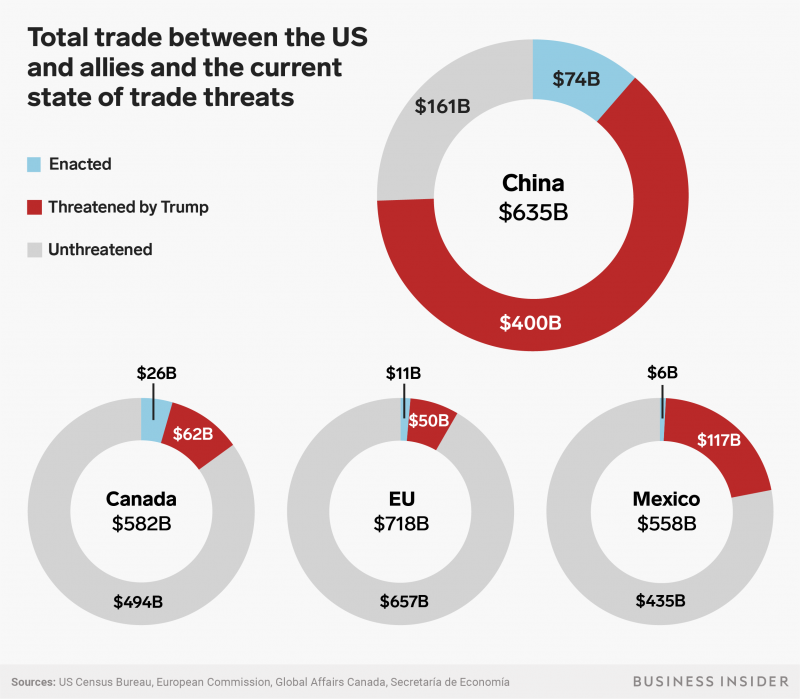

So far, the enacted tariffs haven't hit a large percentage of goods with major trading partners, but that could change in a hurry.

China is the biggest target for Trump so far, with 11.7% of the total goods going between the two countries subject to tariffs.

Trump has also threatened to hit another $400 billion worth of Chinese goods with tariffs due to their retaliation. China accused the president of starting the "largest trade war in economic history." While that claim may be a slight exaggeration now, it may come true in time.

The fight with Canada is the second-largest front in the trade battle, with 4.5% of total trade with the US subject to tariffs. Canadian Prime Minister Justin Trudeau has called the tariffs "insulting."

Just 1.5% of the total trade between the US and EU is subject to tariffs, and 1.1% of trade between the US and Mexico.

For the EU, Canada, and Mexico, the amount of trade subject to tariffs would increase dramatically if Trump follows through on his threat to place tariffs on imports of cars and auto parts.

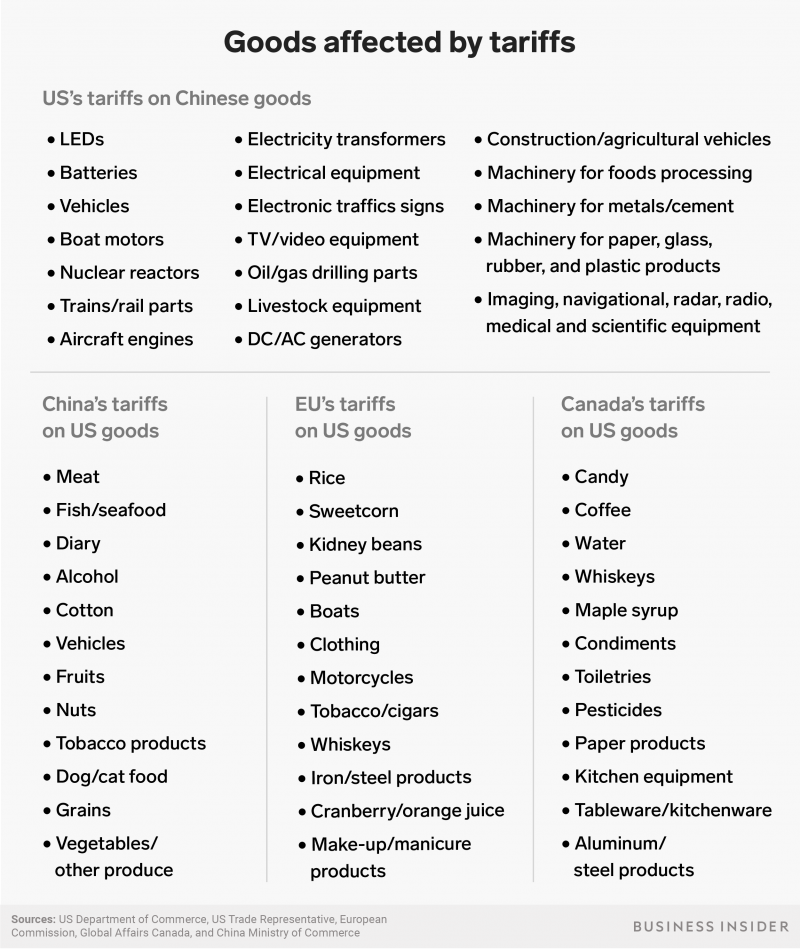

The goods subject to tariffs are wide-ranging — from bulldozers to chicken incubators to hairspray.

Trump's tariffs have so far focused on industrial goods like metals, machinery, and components.

In particular, Trump has tried to attack industries that are part of China's Made in China 2025 plan, which is designed to help boost Chinese companies in a variety of high-growth industries like technology.

By comparison, the retaliatory tariffs from China, the EU, and others predominately go after US agricultural goods, as well as a jumble of consumer products like nail polish and kitchen equipment.

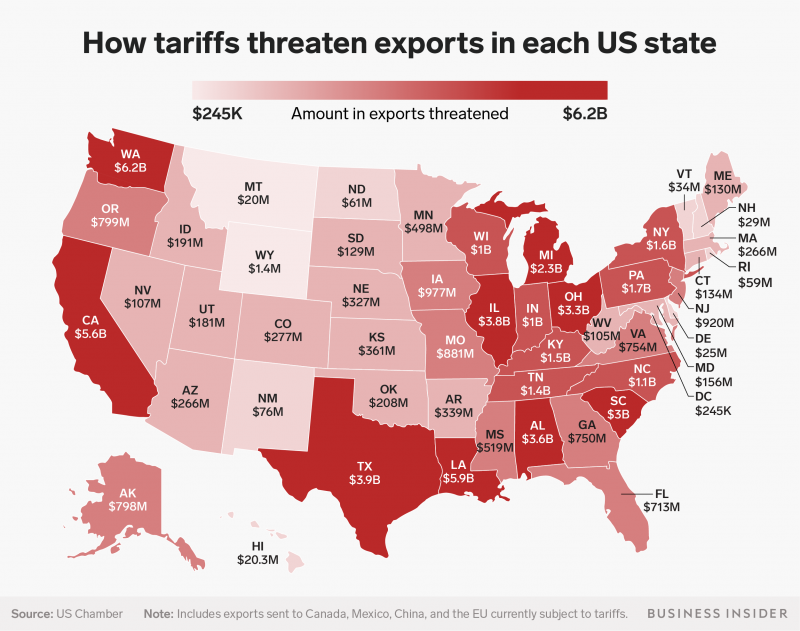

The pain each state feels from the tariffs will vary, but the pattern shows that many countries are trying to make a political point.

The selection of agricultural products by opposing countries doesn't appear to be random.

According to most analyses, much of the pain from the tariffs will hit areas where Trump won in the 2016 presidential election. Analysts say this is designed to increase political pressure on Trump, especially as the 2018 midterms approach.

So far most polls show that Americans are opposed to the tariffs, and Republicans in Congress have attacked the decision by the president since day one.

Prices for goods hit by Trump's tariffs are already starting to rise.

The most immediate effects of the tariffs has come on prices of goods hit by tariffs.

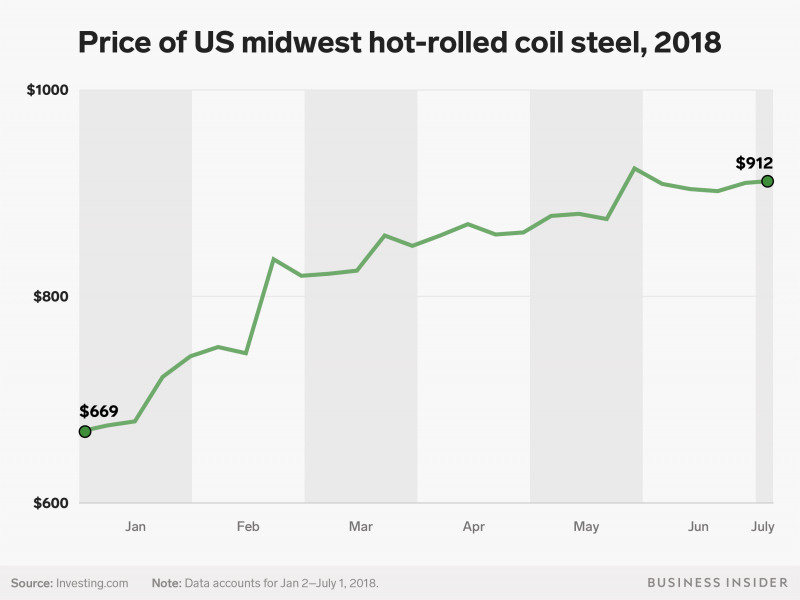

For instance, US steel and aluminum prices have soared since the imposition of tariffs. US midwest hot-rolled coil steel price, the US steel price benchmark, soared 36% between the start of the year and the start of July. This in turn causes prices of goods made with the metal to rise.

Homebuilders are reporting higher prices for metal goods. And the cost of consumer washing machines, which were hit with a tariff in February, have similarly soared.

Even companies that use American-made metals are getting pressured. Middleby Residential, a California-based company that makes Lynx grills, told the Dallas Morning News that even though the company uses US steel, the recent price pressures have driven up costs by almost $350 per grill.

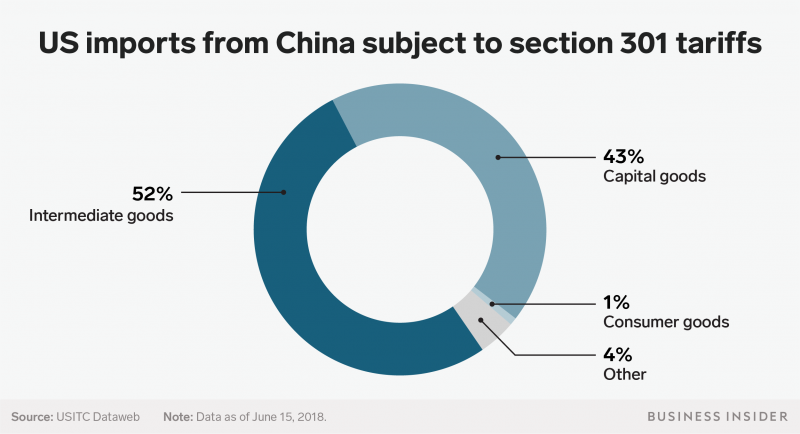

So far, Trump has avoided hitting consumer goods like clothes, but what he did target could be just as problematic.

According to the Peterson Institute for International Economics, Trump's tariffs have focused primarily on intermediate goods, or parts.

That causes major issues for US businesses that use parts from overseas to create a finished product, prompting increased costs for American manufacturers and pressure to cut in other areas, raise prices, or both. The possible result: price increases for consumers or layoffs at these firms.

For instance, Moog Music - the manufacturer of the legendary Moog synthesizer - warned that some suppliers of circuits use parts from China and raised prices in response to the tariffs. That trickled down to Moog, prompting the company to tell customers that they would either have to raise prices, lay off workers, or move production out of the US.

The backlash from other countries is already starting to hit American businesses, too.

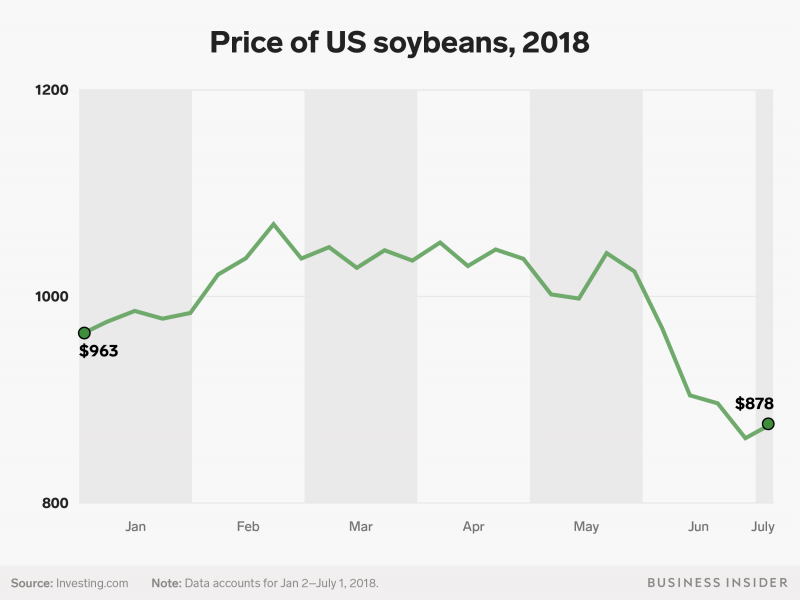

Soybeans are the US's largest agricultural export to China, with more than $14 billion going across the Pacific in 2016. Since China hit soybeans with a retaliatory tariff, US prices have cratered, putting the squeeze on American farmers.

Other companies facing retaliatory tariffs are also struggling with their effects. Most notably, iconic American motorcycle manufacturer Harley Davidson cited the European Union's tariffs on US motorcycles as a key factor in their decision to move a significant amount of production outside of the US.

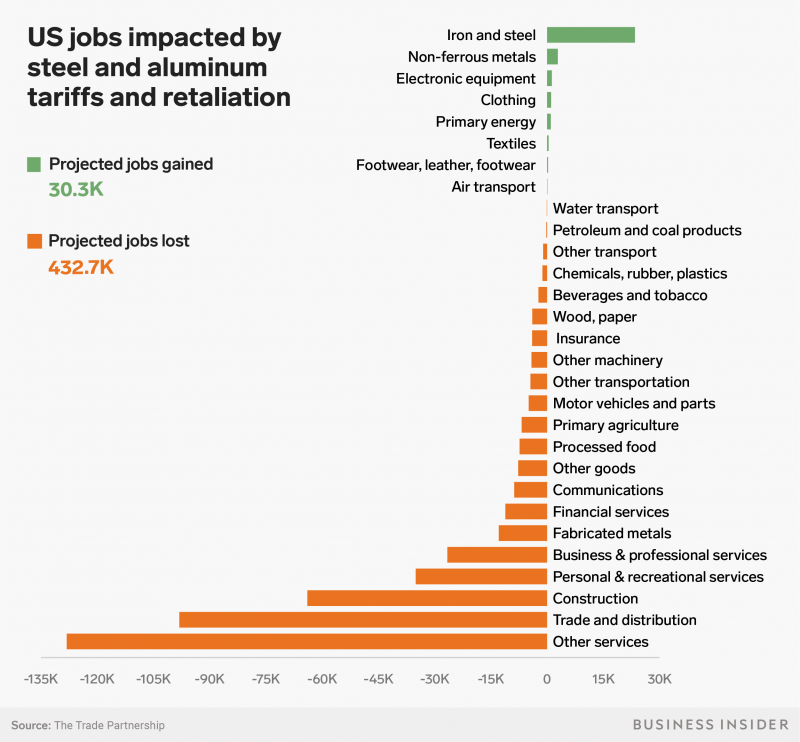

In the end, most economists expect the tariffs to cost American jobs and produce a drag on the US economy.

While the tariffs may provide a boost to concentrated industries like steel production, the losses will far outstrip the gains, economists say.

For instance, the Trade Partnership - an industry group that analyzes free trade - found that the steel and aluminum tariffs would result in approximately 400,000 lost US jobs. Layoffs from the cost increase at manufacturers that use the metals could be far larger than the roughly 30,000 jobs in steel and aluminum production that could be gained.

These cost cuts, price increases, and layoffs will add up, economists say. The ultimate result: A slowdown US GDP growth, and pain for the economy.